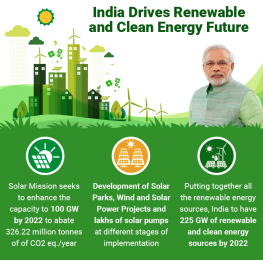

India’s energy future : To secure India’s energy future, create a sovereign wealth fund and invest

To secure India’s energy future, create a sovereign wealth fund and invest

Some analysts believe that the big thrust on electric vehicles (EVs) will spell the end of the oil age. But will it? Electric cars still account for less than 2% of all cars sold worldwide and there are no alternatives for heavy trucks — the biggest oil consumers in India.

Some analysts believe that the big thrust on electric vehicles (EVs) will spell the end of the oil age. But will it? Electric cars still account for less than 2% of all cars sold worldwide and there are no alternatives for heavy trucks — the biggest oil consumers in India.

EVs depend on the reliability of supply chains for key minerals — rare earths, lithium and cobalt — the majority of which are from, or controlled by, China. For a range of reasons, the obituary for oil looks premature. India’s oil demand is set to rise in the foreseeable future.

Luckily, the energy market is currently in India’s favour. This is due to increased oil production in the US and Canada over the past decade, which has brought down the price of oil. The US has added 8.5 million barrels/day to its oil production from 2008-18, accounting for over 70% of the increase in global oil production over this period. Canada added 2 million barrels/day to its oil production in the same period. This increased supply and the short-term demand disruption caused by Covid-19 means that oil prices will remain weak for some time.

This also means that upstream oil and gas investments can be made on the cheap today. Such investments can protect India from future increases in oil prices as financial returns from them will increase in line with oil prices. This approach is in contrast with India’s traditional one, where India’s State-owned oil companies invested in oil and gas fields. Most investments were made in economies such as Russia, Mozambique and Venezuela — and many have run into political or economic instability.

An investment in developed economies, especially the US or Canada, carries fewer risks. Historically, the cost of assets in stable western countries was a deterrent, but with the low oil prices of the past few years, especially in 2020, many of these investments now look attractive.

To do so, India must set up a sovereign wealth fund to invest in listed oil and gas companies — in contrast with the country’s public sector acquiring assets, or companies. First, oil and money are both fungible. The higher dividend payout from energy investments will offset the impact of higher prices. Second, large-scale acquisitions by foreign State-owned companies are not favoured either in the US or Canada, more so in the current environment of predatory investments by Chinese companies.

To do so, India must set up a sovereign wealth fund to invest in listed oil and gas companies — in contrast with the country’s public sector acquiring assets, or companies. First, oil and money are both fungible. The higher dividend payout from energy investments will offset the impact of higher prices. Second, large-scale acquisitions by foreign State-owned companies are not favoured either in the US or Canada, more so in the current environment of predatory investments by Chinese companies.

However, sovereign wealth fund’s from across the world routinely invest in western financial markets as they are seen purely as financial investors, not acquirers. Third, there is the risk of accidents and, therefore, unlimited exposure.

For instance, BP discovered in 2010 after the Gulf of Mexico disaster that there is no upper limit to penalties for environmental damage. An Indian public sector company with an operational stake may be liable in case of an unfortunate event. A sovereign wealth fund with a minority stake will not be liable.

Norway is an example of prudent management of the windfall from high oil prices of the past, with which it set up a rainy day fund — now one of the most powerful and successful in the world. India is witnessing a similar windfall, in reverse, due to low oil prices — and needs to plan for the time when prices will be higher. That time is now.

India’s energy future

Source: Hindustan Times |Amit Bhandari

For more details : Ensemble IAS Academy Call Us : +91 98115 06926

Email: [email protected] Visit us:- https://ensembleias.com/

#India_energy_future #oil #gas #petrol #india #prime_minister #narendra_modi #BJP #blog #current_affairs #daily_updates #free #editorial #geographyoptional #upsc2020 #ias #k_siddharthasir #ensembleiasacademy #Arun_Jaitley #Constitution